ABOUT US

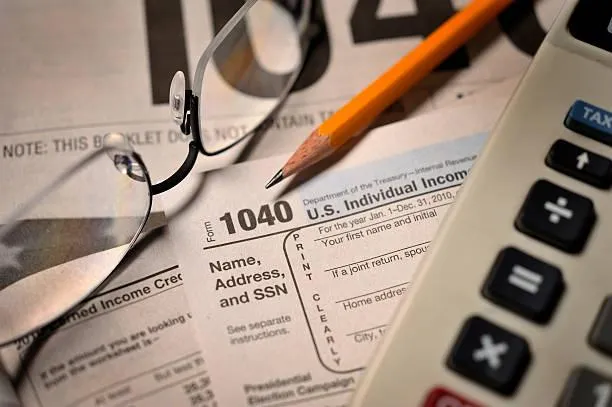

Building 6-Figure Tax Offices

One Entrepreneur at a Time

Passionate About Empowering Tax Professionals

Teresa Oakley, Founder of Number One Tax and Software Solutions LLC, has built years of experience in the tax and financial services industry. Helping aspiring tax professionals turn their passion into thriving businesses.

Whether it’s launching a service bureau, understanding IRS processes, or navigating complex client cases, she's here to help you lead with confidence, clarity, and integrity.

Helping others succeed in the tax industry isn’t just business; it’s a calling. I’ve seen too many professionals feel stuck due to a lack of support or direction.

That’s why my mission is to create systems, mentorship, and resources that simplify your journey, whether you’re launching, growing, or expanding your services.

WHY WORK

WITH US ?

We Are Experienced Professionals with in-Depth Knowledge of Your Industry.

Number One Tax and Software Solutions LLC is committed to helping individuals and businesses navigate taxes and related financial matters with ease. We provide professional, affordable tax services designed to make filing accurate, stress-free, and efficient.

Our team supports a wide range of clients, from W-2 employees and self-employed professionals to college students, gig workers, and more. We also offer a cash bonus through our referral program, along with fast, free estimates to ensure you receive your maximum refund.

You can file securely from anywhere in all 50 states. Prefer an in-person meeting? We’re happy to welcome you for a face-to-face appointment.

At Number One Tax and Software Solutions LLC, we combine expertise, convenience, and personal service to help you achieve your financial goals with confidence

We’re Hiring Tax Preparers,

Get Trained, Get the Tools, Get Paid—All for $99

Get Paid to Prepare Taxes — Join Our Elite Tax Prep Team

Join Number One Tax & Software Solutions as a preparer and get everything you need to start fast: Tax Software, Software Training, Tax Preparers Course, and Mentorship Training, all included in your $99 team access.

Tax Software

Pro-grade, ready on day one.

Fast e-file with accuracy checks & bank products

Client portal, e-signature, secure document upload

Software Training

Get set up and shipping returns fast.

Step-by-step install + first-return walkthrough

Live Q&A and short rewatchable tutorials

Tax Preparers Course

Learn the workflow, rules, and real cases.

Due diligence, common credits, PTIN basics

Sample returns + quizzes to certify you

Mentorship Training

Never get stuck on a live file.

Weekly office hours and case review

Priority chat support from senior preparers

What you’ll do

Prepare individual (1040) returns (business returns if qualified).

Collect and review client documents, verify ID, and ensure compliance.

Communicate status, e-signs, and next steps with clients.

Follow our quality checklist and record-retention standards.

What you’ll need

PTIN (or willingness to obtain—we’ll guide you).

No EFIN required — you’ll work under our EFIN (subject to compliance).

Computer, reliable internet, and great customer service.

Accuracy, integrity, and willingness to learn.

How the process works

Apply (2 minutes) — short interest form.

Join for $99 → get portal access and your onboarding checklist

15-min Interview/Assessment — meet the team, review expectations.

Onboard & Train — software access + quick-start modules.

Start Preparing — supervised returns until you’re fully cleared.

Competitive per-return pay + performance bonuses. Details shared at interview.

We follow IRS identity verification, data security (WISP), and record-retention standards.

CHECK OUT OUR PACKAGES

Prefer an all-in-one system? ERO UNIVERSITY includes training, accountability, Service Bureau track, and your 2025 software license (a $399.99 value).

Do you just need software or want to resell it? Grab the standalone options below.

BOOK A FREE STRATEGY CALL NOW

LETS ASSESS YOUR GOALS AND MAP THE FASTER PATH FOR SUCCESS

© 2025 Number One Tax and Software Solutions LLC